Understanding Capital Expenditure Capex: Definitions, Formulas, And Real-world Examples

A capital expenditure (“CapEx” for short) is the fee with both cash or credit to buy long-term physical or mounted assets used in a business’s operations. The expenditures are capitalized (i.e., not expensed instantly on a company’s revenue statement) on the steadiness sheet and are considered an funding by a company in expanding its enterprise. Capital expenditures are recorded as long-term belongings on the steadiness sheet beneath property, plant, and gear (PP&E). These property are the tangible and intangible sources a enterprise owns and relies upon so as to generate revenue over multiple years.

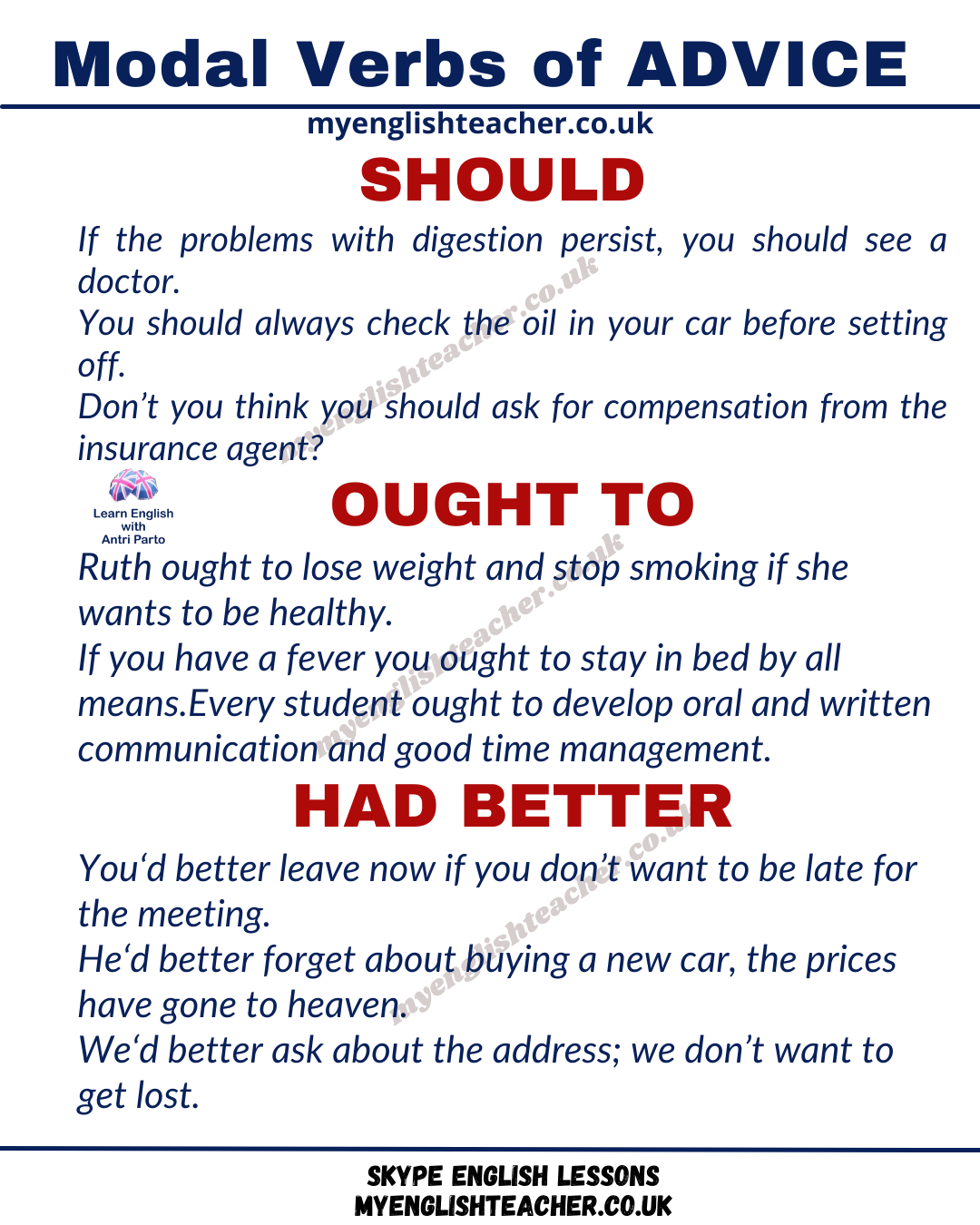

The Position Of Depreciation In Capex

A good metric to trace is asset utilization – how much of an asset’s capacity is being leveraged. Compare gear output or productivity to whole potential output. This lets you precisely monitor the vehicle value over time as it depreciates.

Capitalized Software Growth Costs

The distinction between capital expenditure (Capex) and operating bills (Opex) is as follows. If you buy software program with a one-time payment and it has a useful lifetime of greater than a yr, you usually deal with it as capital expenditure. If you pay for software program via a monthly or annual subscription, you usually deal with it as an operating expense. The difference between capital expenditure (capex) and working expenditure (opex) is determined by how long the acquisition benefits your small business. Reviewing changes in these quantities periodically helps ensure your fixed assets are being depreciated correctly. It’s necessary to regularly observe capital asset performance and adjust depreciation schedules when needed.

When capital expenditures flow seamlessly to the cash circulate statement, money projections accurately mirror deliberate investments. While depreciation expense reduces the carrying value of mounted property (PP&E) on the balance sheet, there isn’t any actual cash outlay. Straight-line depreciation is a common methodology that allocates the value of the asset evenly over its helpful life. Accelerated depreciation allocates more of the fee in the earlier years of the asset’s life. This technique is suitable for belongings that are expected to generate more income within the earlier years. Depreciation is the method of spreading the price of a tangible capital asset over its expected helpful life.

![]()

CapEx is the investments that an organization makes to develop or preserve its enterprise operations. Capital expenditures are much less predictable than working expenses that recur persistently from yr to year. Shopping For costly tools is taken into account CapEx, which is then depreciated over its useful life.

- Making an intensive assessment of CapEx wants, whether or not for upkeep, new acquisitions, or growth from completely different departments determines the vary in how a lot to finances for CapEx.

- A capital expenditure is a long-term investment in an asset that gives future financial benefits.

- It creates a direct line between operational choices and cash influence.

- This is the arrangement whereby one celebration (the lessee) obtains the right to use a capital asset owned by one other get together (the lessor) for a specified time period, in change for periodic funds.

- Both decisions may be good in your company, and different selections might be needed for different initiatives.

The determination of whether or not to expense or capitalize an expenditure relies on how long the benefit of that spending is expected to final. If the benefit is lower than 1 12 months, it should be expensed immediately on the revenue statement. If the benefit is greater than 1 yr, it must be capitalized as an asset on the stability sheet.

In the realm of finance, it’s crucial to grasp how capital expenditures differ from operating expenses. Capital expenditures characterize important investments that enhance a company’s long-term belongings, while operating bills cover ongoing, day-to-day actions. On the stability sheet, depreciation and amortization cut back the guide value of assets, thereby providing a more accurate illustration of their current worth.

This distinguishes it from an operational expenditure, which is an expense that’s associated to an asset bought and consumed throughout the identical tax year. For instance, printer paper is an operational expense, while the printer is a capital expense. Let’s think about an instance of an organization accounting for restore and maintenance prices.

Asset accounts meticulously observe each capital expenditure, portray a vivid picture of the company’s mounted assets. These accounts seize the original price of the asset, any accrued depreciation, and the book value, which estimates the asset’s present worth. By delving into these accounts, stakeholders achieve invaluable insights into the company’s funding strategy and its impression on the steadiness sheet. The balance sheet, a monetary assertion that gives a snapshot of a company’s monetary health, is the place capital expenditures are recorded. They are added to the asset part of the stability sheet, specifically underneath non-current assets.

On the other hand, progress CAPEX is the investments that are made to broaden a company’s operations or to assist enhance its profitability. These expenditures are forward-looking and are centered https://www.intuit-payroll.org/ on increasing production capability, coming into new markets, or improving the company’s general efficiency. For example, purchasing further supply automobiles to cater to a larger customer base or building a new manufacturing facility to meet rising demand would be considered development CAPEX.